Bitcoin and Ether Prices Decline Amid Ongoing Crypto Weakness

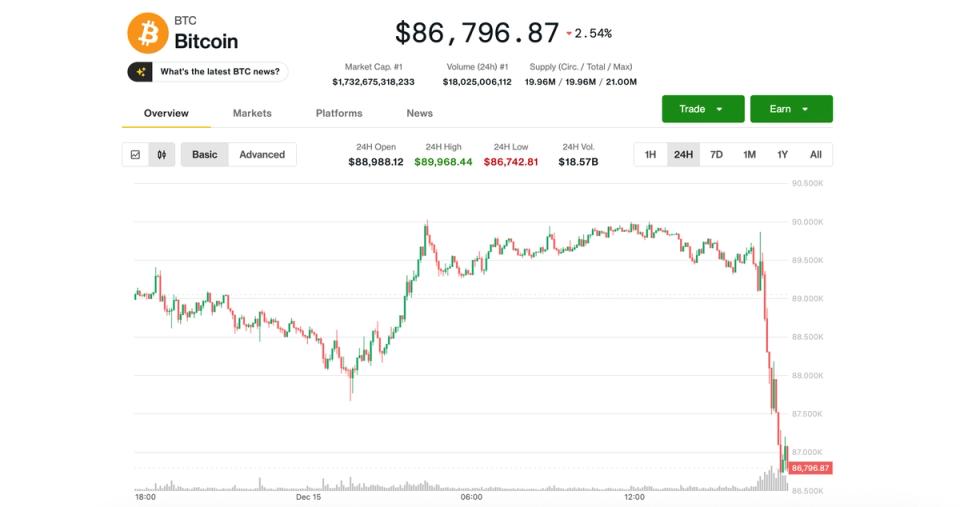

On December 15, 2025, Bitcoin's price dropped to $86,800 during mid-morning U.S. trading, down from around $89,629.86 overnight. Ether also fell to $3,000. This decline continues a pattern where cryptocurrencies underperform during U.S. trading hours compared with the rest of the day.

Crypto equities experienced significant losses as well. Strategy/Marquee? (MSTR) and Circle (CRCL) fell about 7%; Coinbase (COIN) dropped more than 5%; Robinhood (HOOD) and eToro (ETOR) declined roughly 2%; and Gemini (GEMI) decreased by 10% after a late surge. Additionally, crypto mining companies CLSK, CIFR, HUT, and WULF each declined more than 10%.

Regarding investment products, the iShares Bitcoin ETF (IBIT) showed a notable performance difference: owning shares only after-hours would have resulted in approximately a 222% gain since trading began, while intraday ownership would yield a loss of about 40.5%.

The report also highlights the macroeconomic and monetary outlook for the week, including U.S. Bureau of Labor Statistics employment data for October and November, expectations for potential Federal Reserve rate cuts in early 2026, the Bank of Japan's anticipated rate hike for the first time in nearly a year, and upcoming meetings of the Bank of England and European Central Bank.