Bitcoin Bulls Foiled Again as Price Falls Back to $86,000, Giving Up CPI Gains

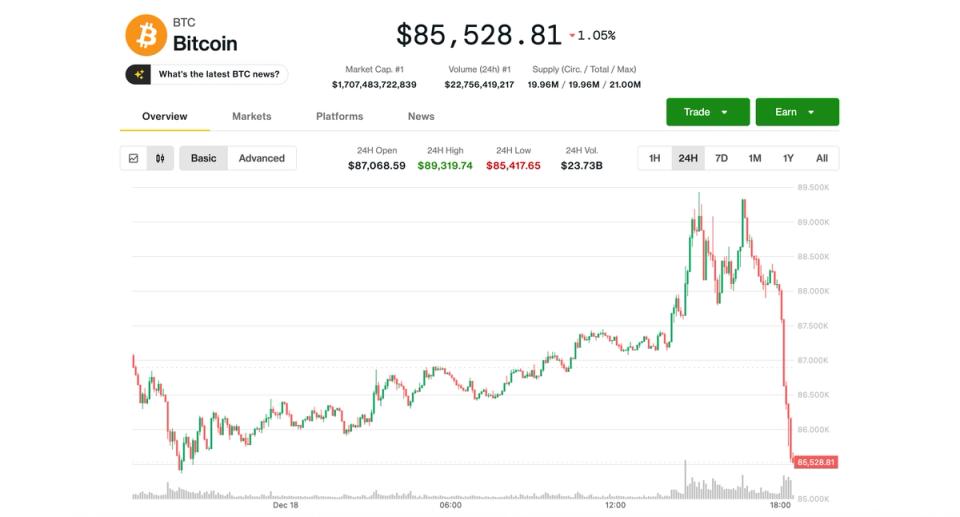

Bitcoin briefly topped $89,000 following a softer-than-forecast November Consumer Price Index (CPI) report but then reversed to around $86,000, with prices reaching a high near $89,300 and dropping to a low near $85,500 during the session.

The U.S. CPI fell to 2.7% year over year in November, which fueled market expectations for easier Federal Reserve policy and drove equities higher. However, the cryptocurrency market quickly retraced these gains.

Some skeptics argued that the October rent and owner’s equivalent rent (OER) component led to the CPI miss, suggesting the inflation reading may understate actual price pressures without this adjustment.

Despite the surprise in CPI data, near-term odds of a rate cut remain around 24%, indicating persistent skepticism about imminent policy easing.

Bitcoin options indicate a range-bound trading setup, with traders selling downside protection below $85,000 and capping upside gains above $100,000.

Ether options show hedging activity with support levels around $2,700 to $2,800 and aggressive selling of upside call options above $3,100.

The overall market pattern is characterized as a bear-market whipsaw, with cryptocurrency prices rallying and then quickly selling off. At the time of reporting, Bitcoin traded around the mid-$80,000 range.