Bitcoin Cycle Turns as Demand Exhaustion Signals Bear Market, Says CryptoQuant

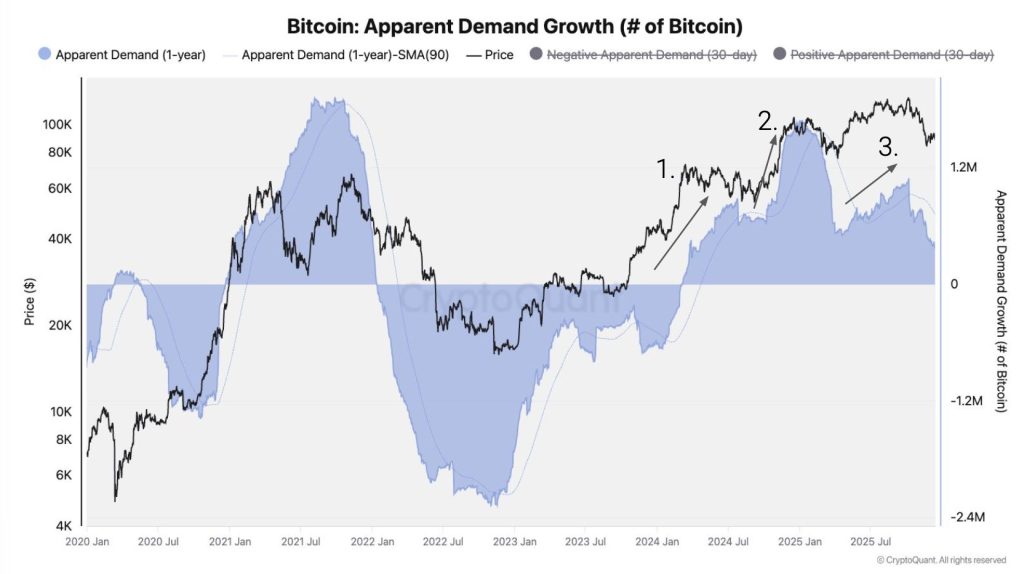

CryptoQuant's Crypto Weekly Report indicates that Bitcoin's market cycle is showing signs of demand exhaustion, transitioning into bear market territory based on on-chain and derivatives data.

Since early October 2025, Bitcoin demand growth has slowed and fallen below its long-term trend after experiencing three major prior spot demand waves: the launch of US spot Bitcoin ETFs, optimism surrounding the US presidential election outcome, and increased interest from Bitcoin Treasury Companies.

Institutional and large-holder demand has weakened, with US spot Bitcoin ETFs shifting from accumulation to distribution in the fourth quarter of 2025, resulting in net holdings declining by about 24,000 BTC.

On-chain analysis reveals that addresses holding between 100 and 1,000 BTC are growing below their historical trend, a pattern similar to what was observed in late 2021 prior to the 2022 bear market.

Derivatives data supports this shift, showing that funding rates for perpetual futures (365-day moving average) have reached their lowest levels since December 2023, reflecting a reduced willingness to maintain leveraged long positions.

From a price and technical perspective, Bitcoin has dropped below its 365-day moving average. CryptoQuant notes that the four-year cycle is primarily driven by demand factors rather than the halving events. With a realized price near $56,000, the cryptocurrency is experiencing approximately a 55% drawdown from its all-time high, while interim support is observed near $70,000.