Bitcoin Long-Term Holder Supply Hits Eight-Month Low Amid Unprecedented Cycle Behavior

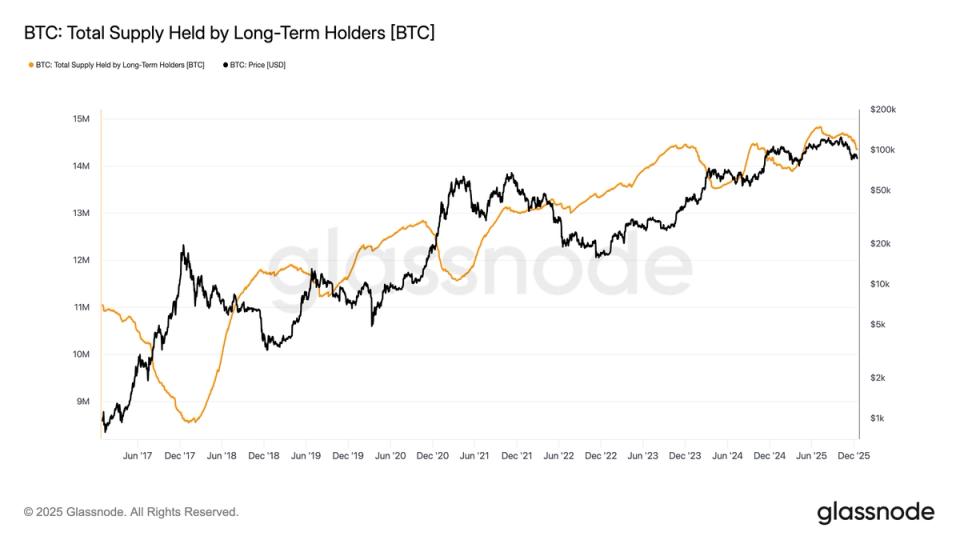

Bitcoin long-term holder (LTH) supply has declined to 14,342,207 BTC, marking an eight-month low last seen in May. The current LTH supply stands at about 14.34 million BTC, with Bitcoin trading around the mid-$80,000 range at the time of publication. This decline represents the third distinct wave of LTH selling in the current cycle since early 2023.

The first wave of selling occurred from late 2023 to early 2024 following the launch of U.S. spot Bitcoin ETFs, during which BTC rallied from approximately $25,000 to about $73,000 by March 2024. The second wave took place later in 2024 as Bitcoin approached the $100,000 mark, driven by optimism surrounding President Trump's election victory. The third wave has unfolded while Bitcoin remained above $100,000 for much of the year.

This cycle breaks from historical patterns observed in 2013, 2017, and 2021, which typically featured a single blow-off top. Instead, this cycle is characterized by repeated LTH distribution without a clear peak. LTH distribution continues to exert significant sell-side pressure and is linked to a nearly 40% correction from October's all-time high.

Glassnode defines a long-term holder as an entity that has held Bitcoin for at least 155 days, with the cutoff around mid-July; buyers after that point are classified as LTH. Despite the repeated waves of selling, the market has absorbed the third LTH selling wave reasonably well according to the report.