Bitcoin Nears $97,000 Amid $1.1 Billion in Liquidations; Altcoins Dip to Multi-Month Lows

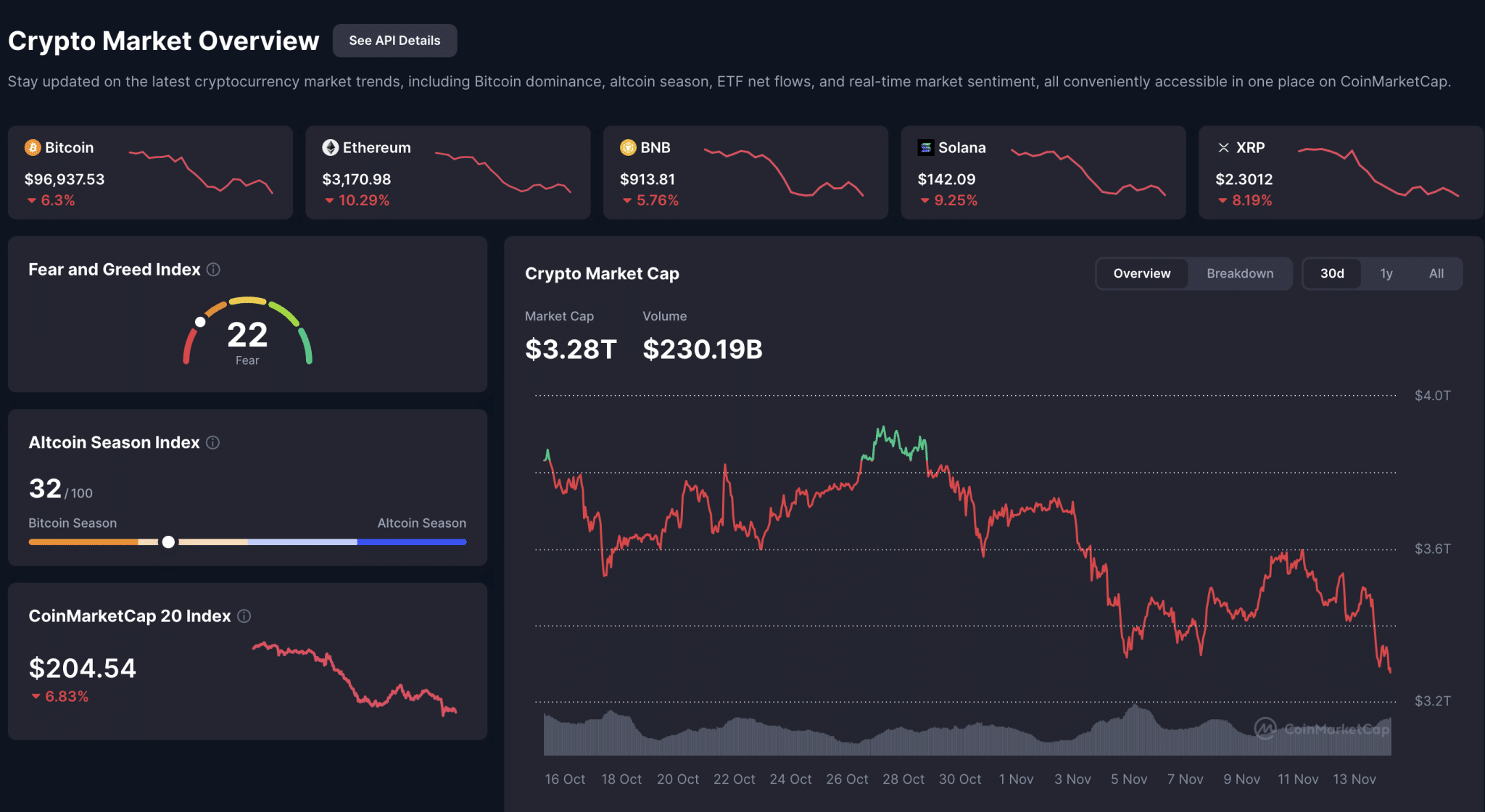

Bitcoin breached the $98,000 support level and traded near $97,000 amid a low-liquidity sell-off. Derivatives liquidations topped $1.1 billion, with approximately $510 million attributed to Bitcoin trading pairs.

Ether (ETH) fell over 9% in 24 hours, while altcoins such as AAVE, JUP, and SUI declined more than 10%. In contrast, privacy coins like Zcash (ZEC) and Monero (XMR) rose, with ZEC gaining more than 1,000% since August.

Altcoins sank to multi-month lows, with volatility metrics showing no panic buying—Bitcoin volatility index (BVIV) was around 50% during Asia hours, now about 47.8%. Open interest in Bitcoin remained flat, whereas ETH and other tokens saw declines in open interest of over 5%.

CME futures data indicated that the ETH premium fell to 4.26%, the lowest since April, while BTC futures premium stayed above 5%. On Deribit, demand increased for BTC and ETH puts, with BTC put spreads and risk reversals and ETH put spreads and calendar spreads dominating trading flows.

Market observers note that the altcoin downturn may depend on Bitcoin’s ability to reclaim the $98,000 level. Failure to do so could signal the beginning of a downtrend or a bear-market reversal from October’s high near $126,000.