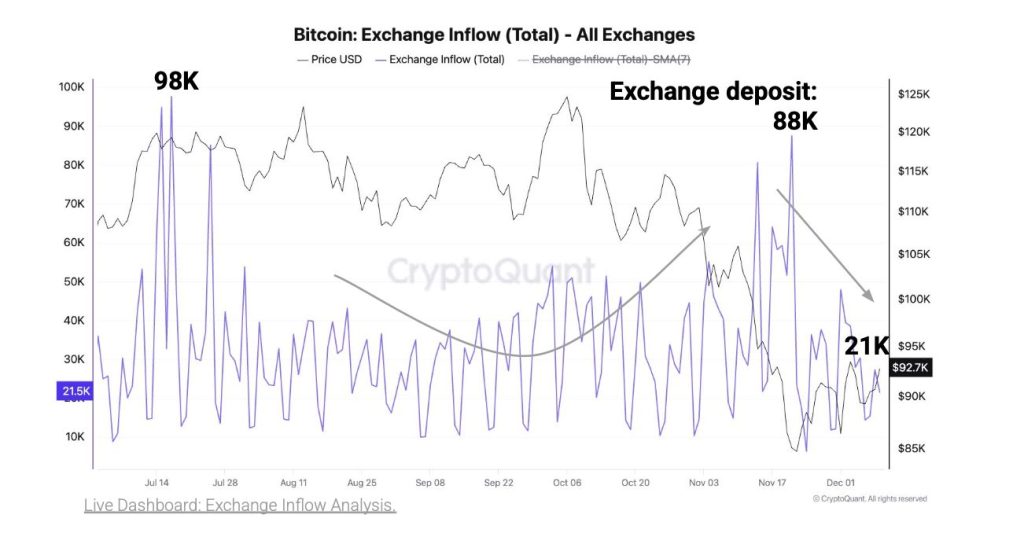

Bitcoin Selling Pressure Eases as Exchange Inflows Drop, Price Rebounds to One-Month High

Bitcoin price rebounded to about $94,000 after briefly falling to $80,000 on November 21, reaching a one-month high according to CryptoQuant. This recovery comes amid a significant decline in Bitcoin exchange deposits, which fell from 88,000 BTC on November 21 to 21,000 BTC recently, representing a 76% drop over three weeks and suggesting reduced sell-side pressure.

The share of exchange deposits from large holders has also decreased, dropping from 47% in mid-November to 21% currently. Additionally, the average transfer size declined from 1.1 BTC to 0.7 BTC. Despite realized losses totaling around $3.2 billion recently—with a peak of $646 million lost on November 13, the highest since July—market sentiment appears calm ahead of the Federal Reserve's policy decision, though potential volatility remains.

Key resistance and support levels for Bitcoin include about $99,000, the lower band of the Trader On-chain Realized Price, $102,000, the one-year moving average, and $112,000, corresponding to the TO-Realized Price. In early December, Bitcoin was near $94,000 and Ethereum near $3,250, supported by MicroStrategy's recent purchases and anticipation around Fusaka, as noted by Laser Digital.

Last updated: December 10, 2025.