Bitcoin Shows Weak Historical Price Support in $70,000 to $80,000 Range

Analysis of five years of CME futures data reveals that Bitcoin spent only 28 trading days in the $70,000 to $79,999 price band, indicating weak historical price support in that zone. In comparison, the $80,000 to $89,999 range experienced 49 trading days, also reflecting uneven testing of price levels relative to lower ranges.

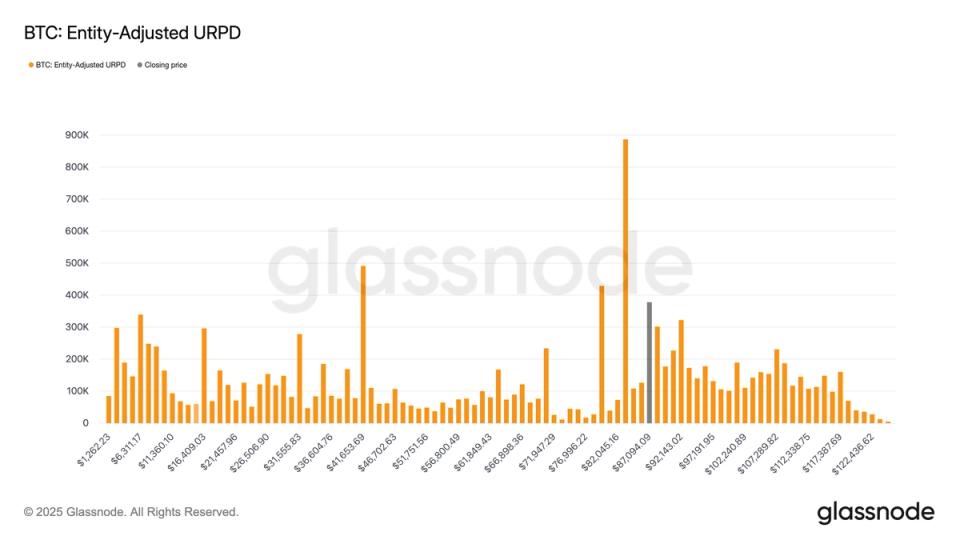

Lower price bands such as $30,000 to $39,999 and $40,000 to $49,999 each saw around 200 trading days, suggesting more extensive consolidation in those zones. This pattern aligns with Glassnode's Unspent Realized Price Distribution (URPD), which shows limited supply concentrated between $70,000 and $80,000, further reinforcing the view of weaker support there.

Bitcoin spent most of December within the $80,000 to $90,000 range following a pullback from the October all-time high, indicating less consolidation in higher bands. If a market correction occurs, the $70,000 to $80,000 region could become a logical area where the price may spend more time consolidating to establish stronger support.

These observations are based on data sourced from Investing.com for trading-day counts and Glassnode for URPD, using the daily open price of CME futures, with weekends excluded.