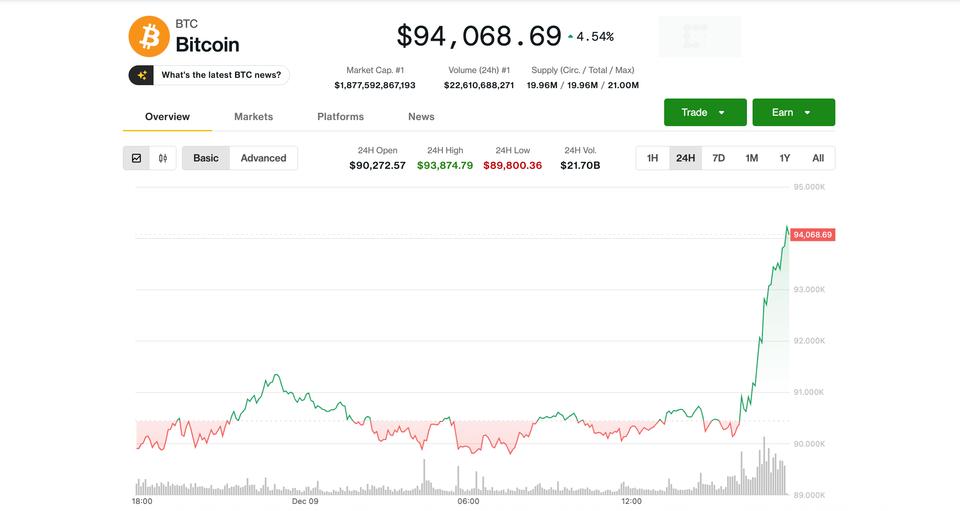

Bitcoin Surges to $94,000 Ahead of Anticipated Federal Reserve Rate Cut

Bitcoin surged back over $94,000 in U.S. trading on December 9, 2025, one day ahead of the Federal Reserve's expected 25-basis-point rate cut. Earlier, BTC rose to about $92,713.24 and then jumped above $94,000 within minutes after 16:00 UTC, gaining over $3,000 in under an hour and rising 4% in the past 24 hours.

Ethereum also rose about 5%, with ADA at $0.4636 and Chainlink at $14.21, accompanied by gains in other native tokens. Silver reached a fresh record above $60 per ounce. Crypto equities saw significant gains, led by Galaxy (GLXY) and CleanSpark (CLSK) with increases over 10%, while Coinbase (COIN), Strategy (MSTR), and BitMine (BMNR) rose between 4% and 6%.

There was no single obvious catalyst for the surge; the move may reflect seller exhaustion after weeks of selling into the U.S. market open. Vetle Lunde of K33 Research pointed to 'deeply defensive' derivatives positioning and crowded positioning as factors potentially contributing to the snapback. In contrast, Geoff Kendrick of Standard Chartered has slashed his outlook for the Bitcoin price over the coming years.

The Coinbase bitcoin premium turned positive recently, signaling a return of U.S. investor demand. BTC's daily price gain outpaced the rise in open interest on the derivatives market, which suggests that spot demand is fueling the rally rather than leverage. The Federal Reserve is expected to cut benchmark rates by 25 basis points at its two-day meeting concluding on Wednesday, a backdrop that could bolster risk appetite.