Bitcoin Trades Near $87,700 as Gold Surges 70% in 2025 Amid Market Uncertainty

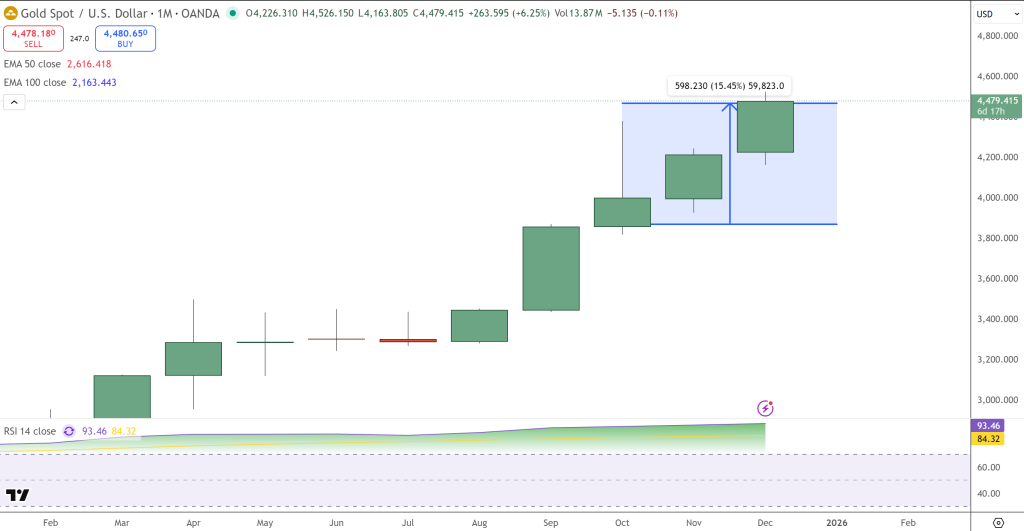

Bitcoin is currently trading near $87,700, down from its peak in October, while gold has risen approximately 70% year-to-date. In contrast, Bitcoin is down roughly 6% over the same period.

Macro risks including geopolitical stress, tariff uncertainty, and fiscal deficits have increased demand for physical hedges, undermining Bitcoin's narrative as a store of value.

Data from Deutsche Bank shows sustained outflows from Bitcoin-linked investment products through November and December, while gold-backed ETFs have attracted inflows.

On-chain data suggests that retail investor capitulation is not evident; the distribution among small wallets remains contained. This indicates that recent declines are driven mainly by institutional rebalancing and derivatives positioning rather than panic selling.

From a technical standpoint, Bitcoin is trading within a two-hour descending wedge channel. Support lies between $86,500 and $86,700, while the 50-day and 100-day exponential moving averages at $87,750 and $87,980 respectively act as overhead resistance. The relative strength index (RSI) is around 52, showing a bullish divergence.

A break above $88,800 could pave the way for further gains toward $90,600 and then $92,700. Conversely, a move below $86,500 could lead to tests of $83,800 and potentially $81,600.

Overall, Bitcoin appears to have lost its status as the market's preferred hedge, and the next decisive move—either up or down—may signal early sentiment heading into 2026.

Last updated: December 25, 2025.