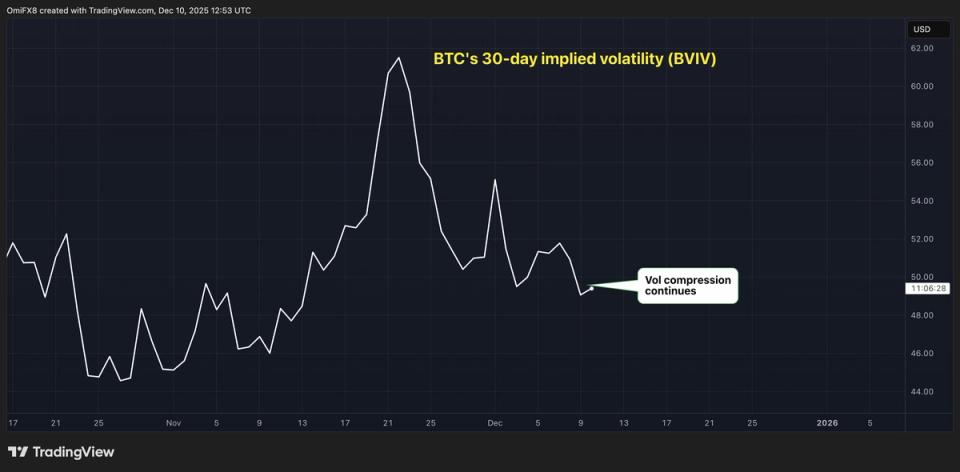

Bitcoin Volatility Compresses, Dimming Year-End Rally Outlook

Bitcoin's 30-day implied volatility (BVIV) has declined to 49%, down from a spike to 65% in late November and around 46% previously. This decline in volatility weakens the case for a significant year-end rally as expectations for price movement have cooled. The S&P 500 VIX also fell significantly to 17% from 28% since November 20, indicating a broad volatility compression extending beyond the cryptocurrency market.

Matrixport commented that this volatility compression suggests low odds of a meaningful year-end upside breakout in Bitcoin's price. The final major catalyst expected is the Federal Open Market Committee (FOMC) meeting, after which volatility is projected to drift even lower into the end of the year. Notably, Bitcoin's historical price-volatility correlation, which had been positive, shifted toward negative since November 2024.

On Wall Street, such compression in volatility is typically associated with a bullish reset in market sentiment, though this dynamic appears to contrast with Bitcoin’s current outlook. The article was published on December 10, 2025, by Omkar Godbole and edited by Sheldon Reback.