Bitcoin Whales Continue Accumulating Near $80,000 Despite Market Fear

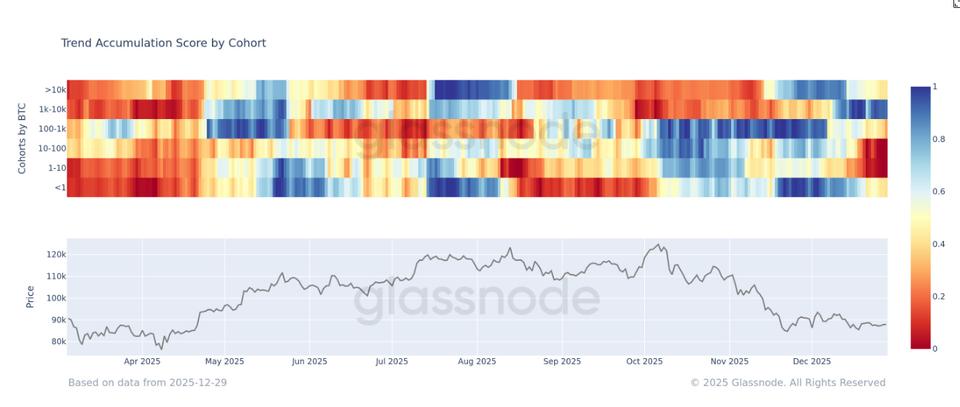

Glassnode data indicates that the bitcoin whale cohort holding between 1,000 and 10,000 BTC has been the main driver of accumulation in recent weeks, maintaining an Accumulation Trend Score close to 1. This score measures net acquisitions by wallet cohorts over the past 15 days, where a value near 1 represents sustained accumulation and near 0 indicates distribution.

This 1,000–10,000 BTC group is currently the only segment showing sustained buying, while holders with fewer than 1,000 BTC are acting as net sellers. The selling behavior of smaller holders aligns with typical capitulation patterns, particularly given that the Crypto Fear and Greed Index has remained in a state of fear or extreme fear for about 30 days.

Bitcoin's price bottomed near $80,000 at the end of November, and large holders have continued accumulating as the price trades just below $90,000. The 10,000+ BTC cohort had purchased aggressively near $80,000 in late November but has since slowed their buying activity. Despite BTC earlier trading above $100,000 this year, this cohort has not begun selling yet.