Bitcoin Whales Unload $3.4B in December Amid Market Pressure

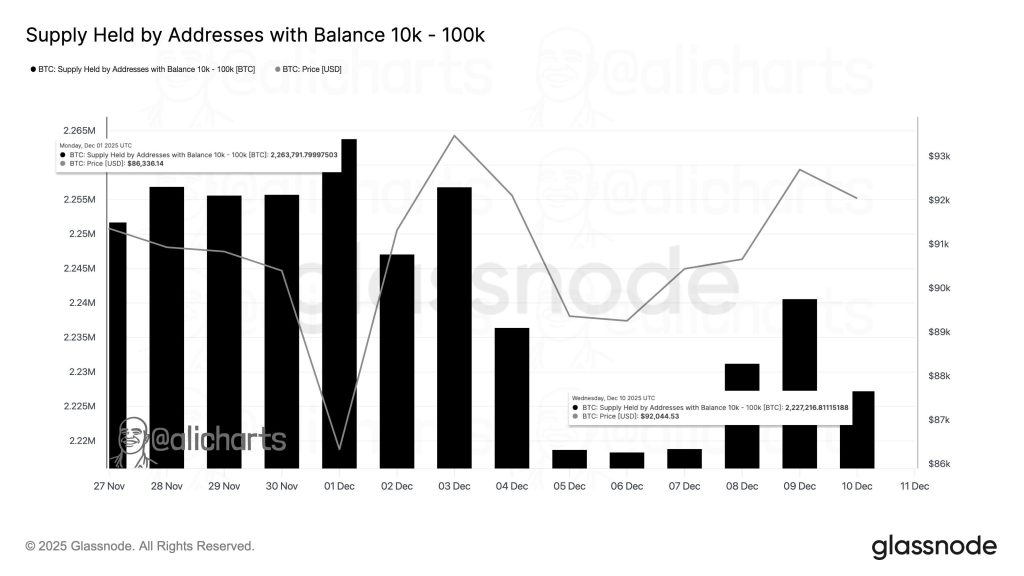

Glassnode data reveals that Bitcoin holders with 10,000 to 100,000 BTC have sold or redistributed approximately 36,500 BTC since December 1, amounting to about $3.37 billion. This significant move suggests distribution by large holders such as institutional custodians and early miners as market liquidity thins.

Currently, Bitcoin trades near $92,250, facing resistance at $94,000 amid a Federal Reserve environment of rate cuts and plans to inject liquidity through monthly Treasury purchases. However, stablecoin liquidity has declined by roughly 50% since August, limiting buying power and reducing the likelihood of a breakout above the $100,000 mark.

In the past two days, Bitcoin and Ethereum ETFs have attracted over $610 million in inflows, indicating growing institutional confidence. For Bitcoin to break out toward $100,000, a daily close above $94,140 is necessary, with immediate support at $90,000 and stronger support around $88,000.

Overall, the market narrative points to smart money pulling back liquidity while retail sentiment remains high, with the $88,000 to $94,000 range acting more as a zone of distribution rather than accumulation.