Chainlink's LINK Dips 5% Despite Coinbase Bridge Deal Amid Market Weakness

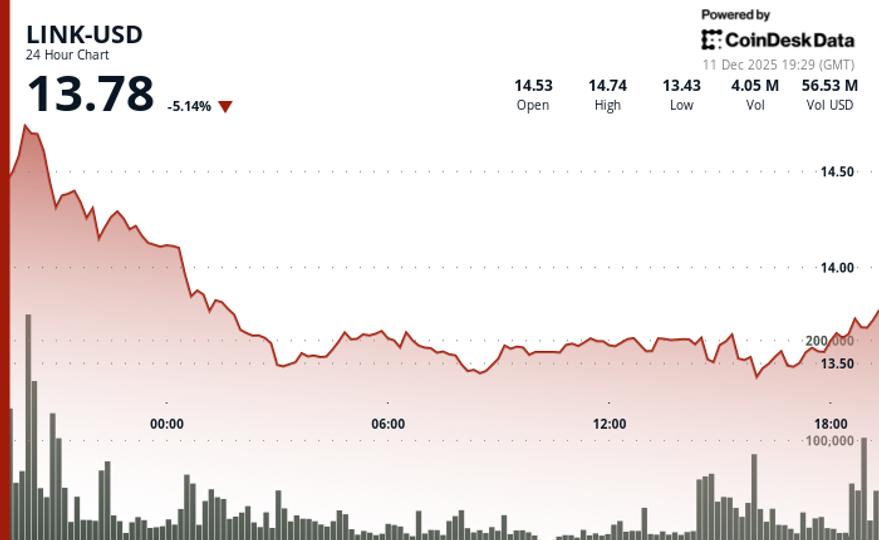

Coinbase has selected Chainlink's Cross-Chain Interoperability Protocol (CCIP) to power a new $7 billion wrapped-asset bridge featuring cbETH, cbBTC, and cbDOGE. Despite this significant development, Chainlink's native token LINK fell approximately 5% in the last 24 hours to $13.74, reflecting broader crypto market weakness.

Throughout the trading day, LINK's price fluctuated between an intraday high of around $14.46 and a low near $13.43. Notably, trading volume surged roughly 20.4% above the 7-day average, with more than 340,000 LINK exchanged during a late-session burst. This increase signals renewed institutional activity near session lows.

Caliber, a Nasdaq-listed digital-asset treasury firm, initiated staking of its LINK holdings to generate yield, starting with a deployment of 75,000 tokens.

Technically, LINK showed signs of accumulation above primary support at $13.46 and consolidated within a range of approximately $13.43 to $13.67. A final-hour breakout to $13.76 suggests possible short-term bottoming. Key resistance levels stand at around $14.00, a psychological barrier, and $14.88. A breakout above $14.00 could target further gains towards $14.38 and $14.88.

These price movements unfolded amid weak altcoin momentum and renewed concerns over the Federal Reserve's rate outlook. However, late-session bottoming signals indicate potential stabilization for LINK despite the broader bearish sentiment in the market.