Crypto Industry Faces Critical Window to Embed Itself as Essential Infrastructure Amid Trump Family Conflicts

Danny Ryan argues that the cryptocurrency industry must prove its usefulness and integrate into the financial system before President Trump leaves office to reduce the risk of political backlash and to position crypto as essential infrastructure.

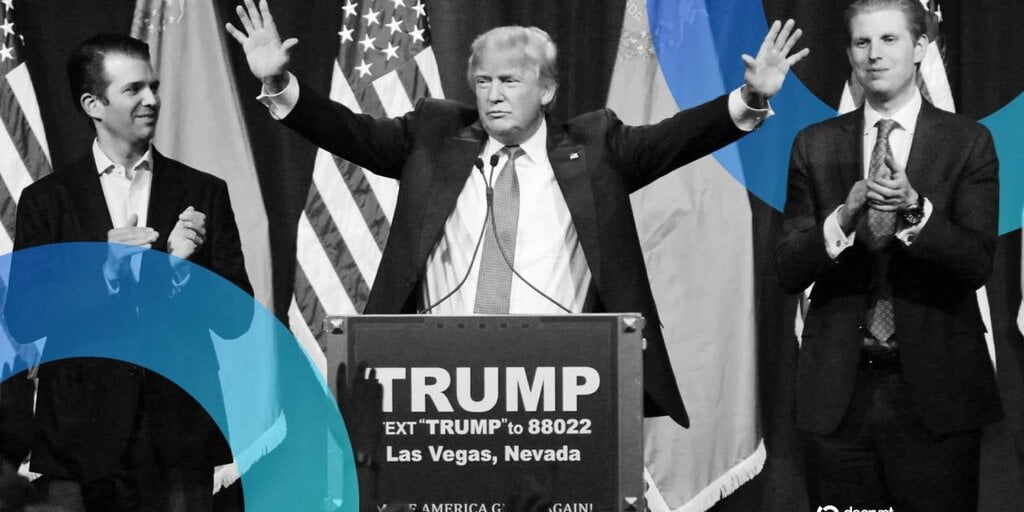

Trump's pro-crypto record and his family's extensive crypto investments have created perceived conflicts of interest, which could hinder progress under a new administration.

There remains a narrow window to onboard financial institutions, global capital, and markets to demonstrate cryptocurrency's fundamental value rather than continue debating its existence.

The GENIUS Act, signed into law in July 2025, established a framework for issuing stablecoins but encountered Democratic opposition due to Trump-related conflicts, including a walkout during a digital assets hearing.

Before his inauguration, Trump issued an officially licensed meme coin followed by Melania Trump, sparking protests and criticism from senators who viewed the episode as an example of corruption.

World Liberty Financial, co-founded by Trump and his sons, released a dollar-pegged stablecoin; Eric Trump disclosed that the family's crypto ventures had generated profits exceeding $1 billion as of October 2025.

Etherealize testified before Congress on the CLARITY Act amidst concerns over Trump family conflicts of interest, underscoring the intense political tension surrounding crypto regulation.

Industry leaders warn that post-Trump regulatory policies could be punitive; their goal is to depoliticize cryptocurrency and present it as valuable infrastructure to be responsibly utilized.