DOGE Exits Range as Selling Pressure Builds at Key Levels

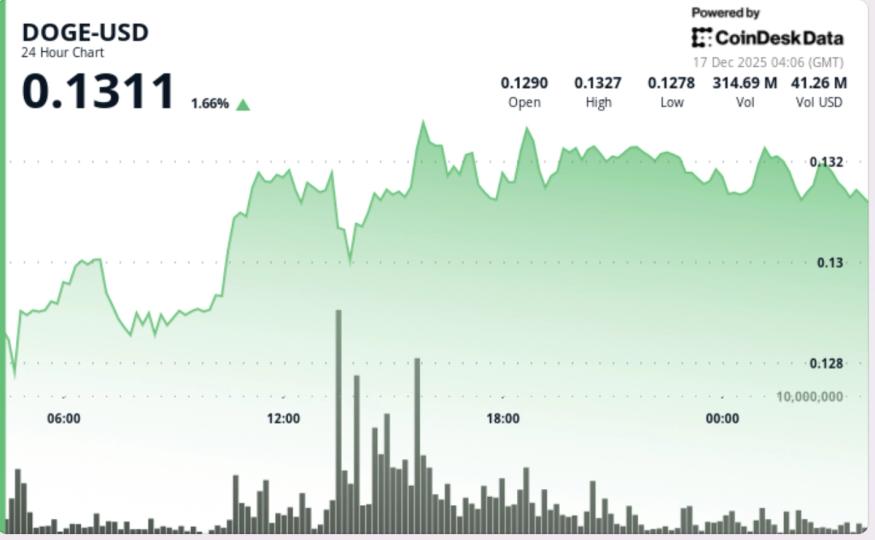

DOGE fell 5% following the Federal Reserve's 25-basis-point rate cut, as traders reacted to cautious guidance and internal disagreements on the pace of further easing. The cryptocurrency broke below the $0.1310 support level, confirming a bearish shift characterized by heavy volume of about 769.4 million tokens and a lower high near $0.1324.

The price action showed a move from approximately $0.1315 down to $0.1266, followed by a rebound to around $0.1291, and closed below key moving averages. Overnight, DOGE slid from $0.1320 to $0.1314 on steady but controlled activity, indicating that sellers remain active on rallies.

The $0.1310–$0.1315 zone has transitioned into a resistance area. Loss of $0.1310 shifts DOGE back into a corrective phase, with rallies likely to encounter selling pressure unless this level is convincingly reclaimed. The key downside level to watch is $0.1290; a sustained break below this could reopen the $0.1266 support area. Conversely, staying above $0.1290 may result in a period of consolidation before the next move.

Volume behavior remains crucial: persistent high volume on the downside supports distribution, while declining volume near support could indicate that selling pressure is waning.