DOGE Surges Above Key Resistance Driven by Ethereum Strength

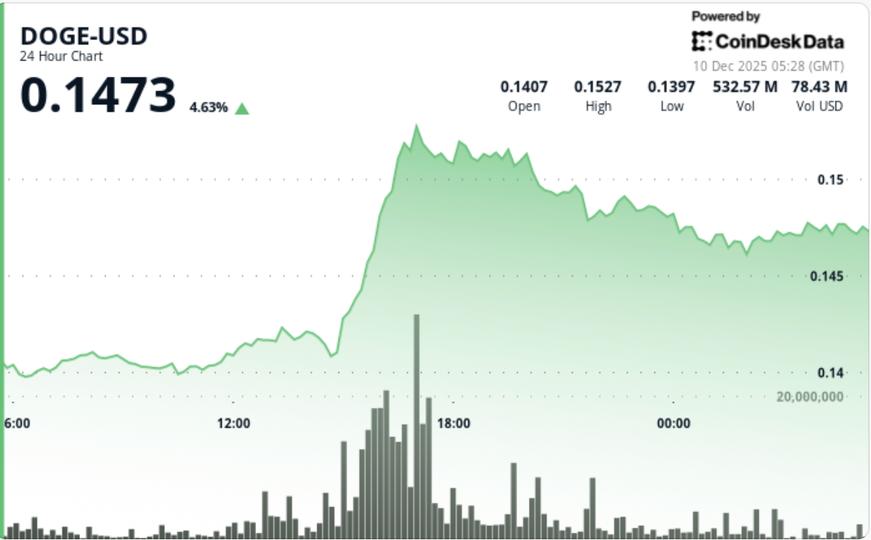

On December 10, 2025, DOGE surged above a key resistance level with roughly a 6% rally, reaching an intraday high of $0.1532 and closing at $0.147307. Trading volume spiked 312% above typical levels between 15:00 and 17:00 GMT, indicating institutional or algorithmic accumulation rather than retail speculation.

Fundamentally, mixed signals were observed: net network outflows totaled $4.81 million despite a rise in on-chain activity, with active addresses reaching 67,511, marking the second-highest level in three months. Technically, this marked a clean breakout above $0.1470—the first in six weeks—with approximately 1.75 billion DOGE traded, about 51% above the seven-day average.

DOGE remains below all major exponential moving averages (EMAs). The 20-day EMA at $0.1476 acts as dynamic resistance, while the 50-, 100-, and 200-day EMAs at $0.1649, $0.1836, and $0.1975 respectively continue to present structural headwinds. Momentum indicators suggest room for upward continuation, with a relative strength index (RSI) of 41 and the moving average convergence divergence (MACD) approaching a bullish cross on four-hour charts.

Key levels to watch include a breakout above the $0.1522 to $0.1530 range to target $0.1580 and the 50-day EMA at $0.1649. Conversely, $0.1470 is a must-hold support; a drop below this level risks a move down to around $0.138.