Dogecoin Breaks Short-Term Support, Eyes Lower Demand Zone

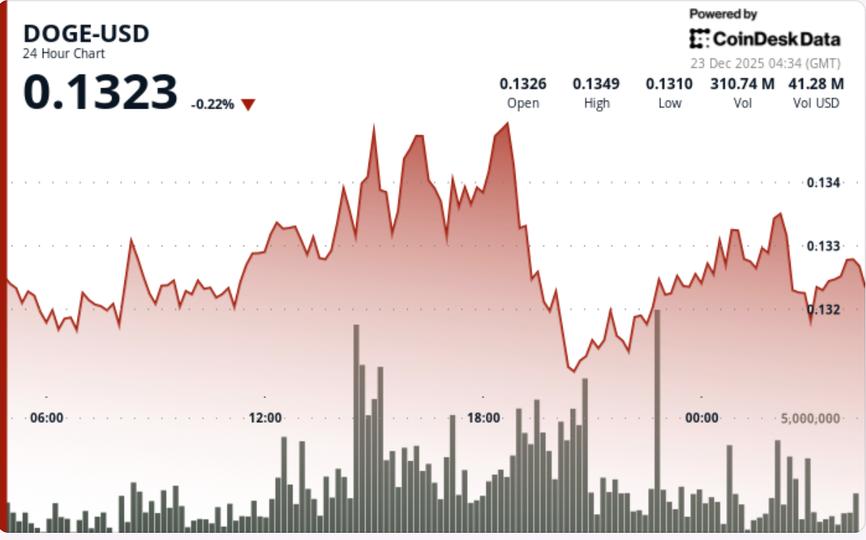

Dogecoin fell about 1.8% in the last 24 hours, sliding from an intraday high near $0.1341 to around $0.1323, unable to sustain gains above $0.135. The loss of support near $0.1320 confirms a bearish short-term bias as the price drifts toward the lower end of its recent range.

Trading volume rose to roughly 721 million DOGE, about 150% above the 24-hour average, indicating active repositioning rather than thin liquidity. DOGE slipped below the lower boundary of a short-term ascending channel, signaling a shift away from the late-week recovery structure.

Resistance at $0.1320 now acts as overhead; the next demand zone near $0.1280–$0.1290 could attract dip-buying if selling pressure eases. To neutralize the bearish structure, DOGE would need to reclaim $0.1320 and then $0.1350; otherwise, rallies may face selling pressure.

Overall, the technical tone suggests controlled selling with momentum tilted lower, showing no sign of panic. Article by Shaurya Malwa (CD Analytics); published and updated Dec 23, 2025.