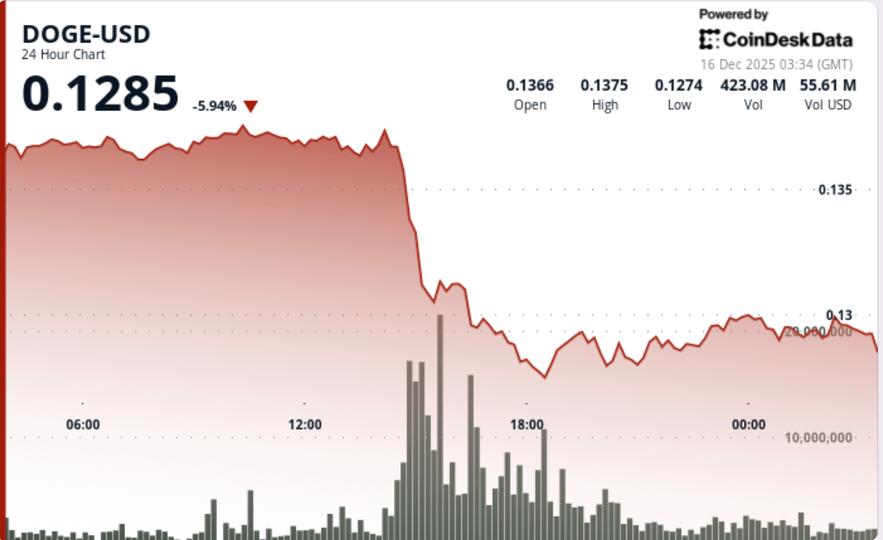

Dogecoin Drops Below $0.13, Drawing Institutional Attention

Dogecoin (DOGE) has experienced a 5.5% decline over the past 24 hours, falling from $0.1367 to $0.1291. A break below the $0.1370 mark represented a decisive loss of short-term trend support, signaling a shift in market structure. Trading volume surged to approximately 1.63 billion DOGE, about 267% above the historical average, amid a selloff driven by weaker risk sentiment and thinner liquidity, as investors rotated out of speculative exposures.

Near-term price direction hinges on DOGE holding above the $0.1290–$0.1280 zone, with $0.1300 acting as immediate resistance. Sustained acceptance below this zone could target the next support level around $0.1250. Conversely, reclaiming $0.1300 would be the first sign that downside momentum is easing.

On a higher timeframe, DOGE remains range-bound, but the recent drop indicates a failure to defend key levels. Intraday price action shows higher lows forming from the $0.1290 base; however, upside follow-through is limited as sellers near $0.1300 cap advances.