Dogecoin Faces Uncertain Outlook Amid Bearish Price Trend and Bullish On-Chain Signals

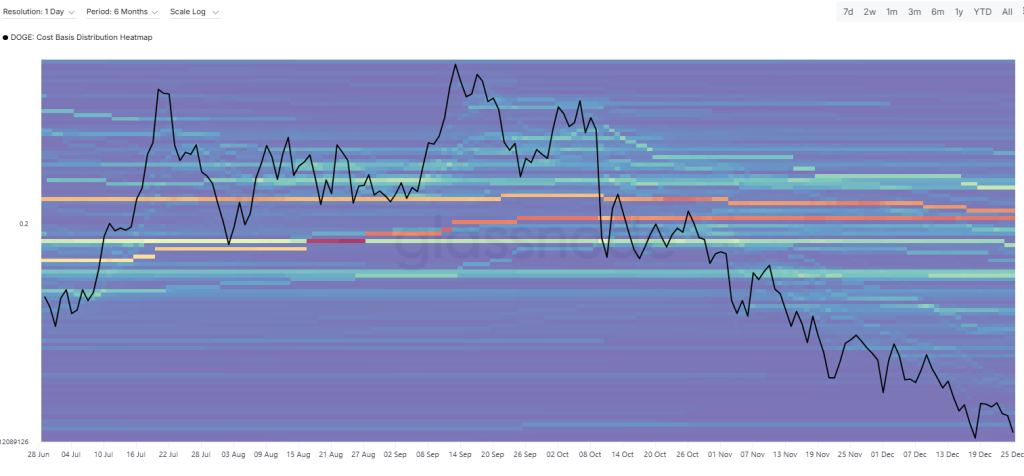

Dogecoin has experienced a prolonged downtrend over several months, with its price currently near $0.125, marking a decline of over 60% year-to-date. The cryptocurrency recently breached a key support zone in the $0.15 to $0.20 range.

On-chain data from Glassnode reveals that while speculative supply is contracting, long-term holders—specifically those holding for 1 to 2 years—are accumulating, their share rising from approximately 21.84% to 22.34% of Dogecoin’s total supply. Additionally, the number of spent coins has significantly decreased from about 251.97 million DOGE to 94.34 million DOGE, a drop exceeding 60%, indicating reduced transfer activity.

Historically, such declines in spent-coin activity have preceded short-term relief rallies. For example, a similar drop coincided with a price rise from around $0.132 to $0.151 in December.

Technically, Dogecoin remains in a clear downtrend on the 4-hour chart, hovering near $0.125, with immediate support identified at $0.12 and resistance at $0.14. A reclaim above $0.16 could signal a shift in momentum, potentially pushing the price toward $0.18 and the $0.20 to $0.21 resistance levels. The Relative Strength Index (RSI) is in the low 40s range, suggesting weak momentum while allowing space for short-term bounces, though not yet confirming a reversal.

Overall, the outlook for Dogecoin is mixed, balancing between a bearish continuation of the downtrend and a potential bullish reversal fueled by positive on-chain activity. A possible macroeconomic factor influencing this dynamic is Bitcoin approaching higher price levels, which might support risk assets including Dogecoin.

Last updated: December 26, 2025.