Dogecoin Maintains Tight Range Near Key Support Amid Fed Rate Cut

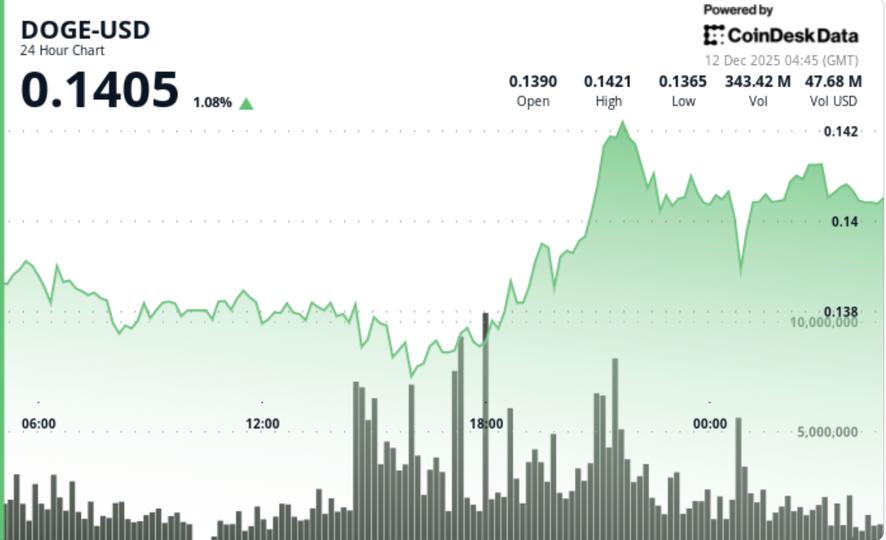

The Federal Reserve recently cut the policy rate by 25 basis points to 3.5%-3.75%, marking the third cut of the year amid internal disagreement among policymakers about further easing. Despite this move, Dogecoin (DOGE) has traded in a tight range between $0.13 and $0.15, currently around $0.1405, marking a modest 0.69% increase over the last 24 hours.

Trading volume stands at approximately 651.7 million DOGE, around 7% above the 7-day average, indicating positioning activity rather than aggressive accumulation. Whale wallets have accumulated roughly 480 million DOGE recently. ETF-related flows from Grayscale and Bitwise spot DOGE ETFs have not yet produced sustained directional momentum.

Key resistance levels are near $0.1425–$0.1430, with support around $0.1380. Dogecoin's price remains within a multi-week range, showing a compression or pennant-like pattern that suggests a larger move may emerge from a breakout or breakdown rather than gradual drifting.

DOGE appears to be more sensitive to broader risk sentiment changes than token-specific catalysts in the current post-Fed environment. A breakout above $0.1420–$0.1450 could propel the price toward $0.16–$0.18, whereas a break below $0.1380 risks a decline toward $0.13.