Dogecoin Price Declines Amid ETF Buzz and Bearish Market Conditions

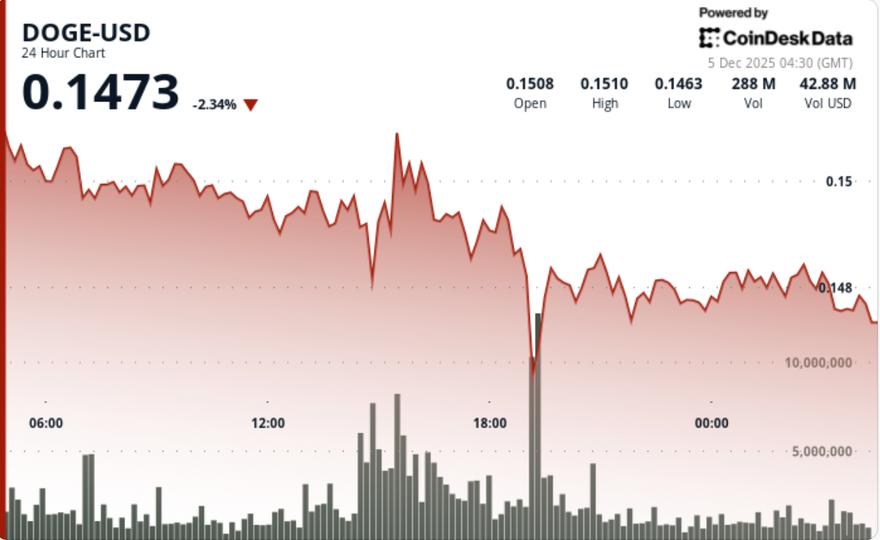

Dogecoin (DOGE) experienced a price decline of about 3% in the latest session, dropping from $0.1522 to $0.1477 with a breakdown occurring at peak trading volume. This drop followed three unsuccessful attempts to surpass the $0.1522 resistance level, as the price breached the $0.1487 support amid a surge in volume, including three consecutive hourly candles exceeding 400 million DOGE.

The price action has formed a descending triangle pattern that suggests a continued bearish trend unless Dogecoin can reclaim the price zone between $0.1487 and $0.1510. Momentum indicators remain bearish, with the relative strength index drifting lower and trend-following signals negative, indicating no immediate reversal is expected despite rising on-chain activity.

On-chain metrics showed an increase in active addresses to 71,589, marking the highest level since September and signaling stronger user engagement despite the weakening price. However, whale activity has remained subdued compared to November amid widespread risk-off sentiment, creating a divergence between on-chain activity and market price.

Regarding institutional developments, 21Shares and Grayscale have advanced filings for spot DOGE ETFs, suggesting potential for broader institutional access in the coming months. Nevertheless, ETF inflows have not yet accelerated.

Key support levels to monitor include $0.1470, with potential further declines toward $0.1450 and $0.1425 if heavy volume continues. To neutralize the current breakdown, bullish momentum must push and sustain prices above $0.1487, with a move above $0.1510 indicating a possible trend shift.