Gold Outperforms Bitcoin in 2025 Despite Strong Bitcoin ETF Flows

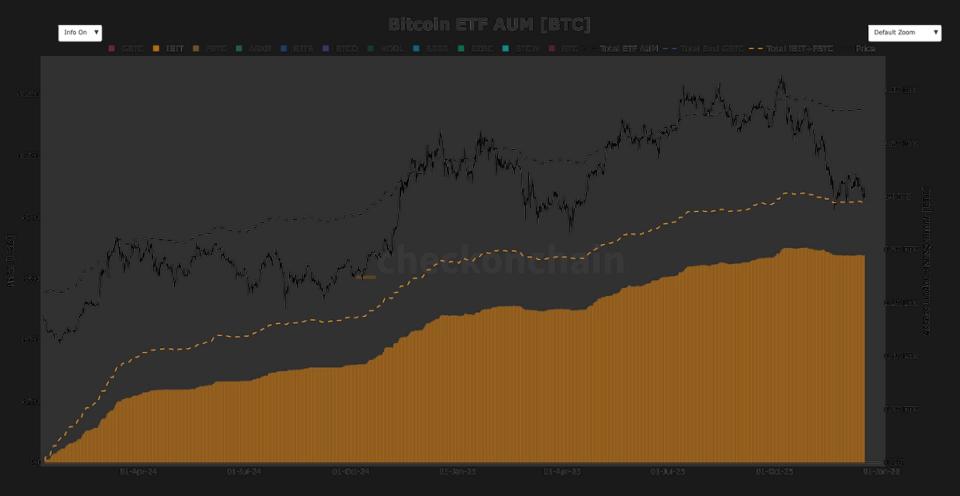

In 2025, gold rose 65% while Bitcoin fell 7%, with both assets initially up about 30% through August. From August onward, gold surged significantly, whereas Bitcoin experienced a 36% correction from its October all-time high, trading near $80,000 by year-end. Despite this price drop, U.S. spot Bitcoin ETF assets under management (AUM) declined by less than 4% in 2025, falling from approximately 1.37 million BTC in October to roughly 1.32 million BTC by December 19.

Bitcoin ETF flows actually outpaced gold ETP flows throughout 2025, according to Bitwise managing director Bradley Duke. BlackRock’s iShares Bitcoin Trust (IBIT) accounted for just under 60% of Bitcoin ETF assets, representing about 780,000 BTC. The debut of U.S. spot Bitcoin ETFs in January 2024 marked the first year of institutional adoption; year two saw continued strong participation from investors even as Bitcoin prices did not necessarily advance.

The year 2025 is characterized as a debasement-trade environment favoring precious metals like gold in terms of price performance, while Bitcoin’s ETF flows displayed resilience despite its price correction.