Gold Surges as Bitcoin Falls in 2025 Amid Divergent Investment Flows

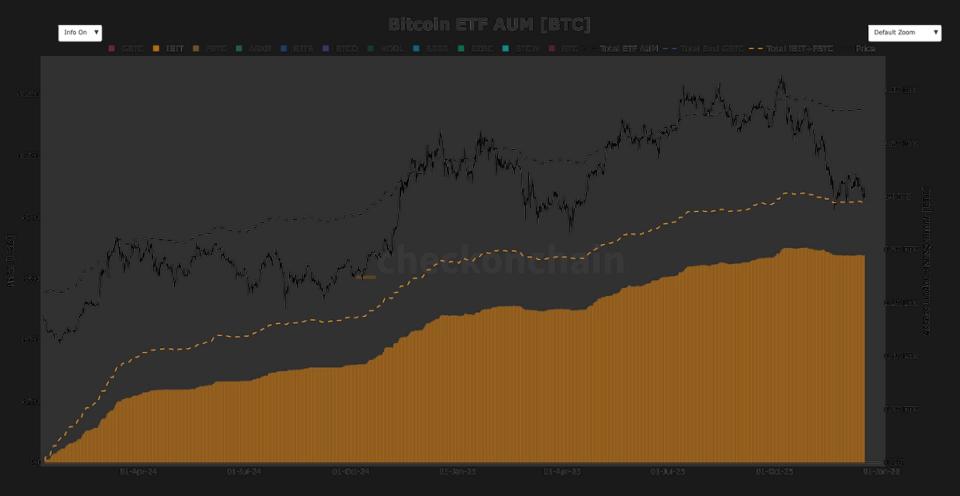

In 2025, gold prices rose by 65%, outpacing Bitcoin, which fell 7% despite both assets being up about 30% through August before their values diverged. Bitcoin experienced a 36% correction from its October all-time high, while U.S. spot Bitcoin ETF assets under management (AUM) declined by approximately 3.6%, falling from around 1.37 million BTC in October to about 1.32 million BTC on December 19.

Data from Checkonchain indicates that U.S. ETFs held roughly 1.37 million BTC at the October peak and about 1.32 million BTC as of December 19. BlackRock’s IBIT fund held approximately 780,000 BTC, just under 60% of the U.S. spot Bitcoin ETF market share during this correction period. Notably, the selloff was not driven by ETF outflows, implying that other holders were responsible for selling.

The introduction of U.S. spot Bitcoin ETFs in January 2024 marked the first year of institutional adoption, with the second year seeing continued strong institutional participation despite the price decline. Throughout the correction, Bitcoin traded around $80,000.

This divergence in asset performance reinforced the narrative that gold won the debasement trade story in 2025, maintaining its status as a preferred hedge while Bitcoin saw price weakness amid strong ETF inflows.