Labour U-turn on Income Tax Rise Sparks Market Volatility and Political Debate

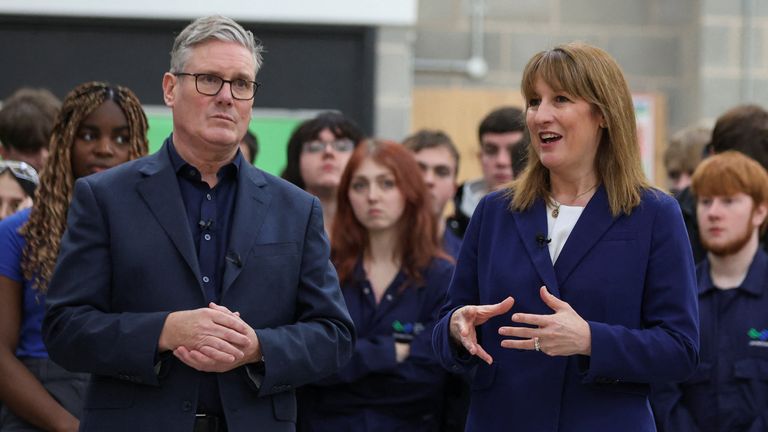

Labour leadership, including Keir Starmer and Chancellor Rachel Reeves, have scrapped plans to raise income tax rates in the Budget 2025, a reversal of manifesto pledges made less than two weeks before the budget announcement. The Financial Times first reported the decision, with Downing Street reportedly backing down due to fears of backlash from Labour MPs and voters. Treasury and Number 10 did not offer comments on the situation.

The U-turn leaves the chancellor with the challenge of filling an estimated £30 billion shortfall using narrower tax measures and extending the freeze on income tax thresholds for two more years beyond 2028, a move expected to raise about £8 billion. Earlier proposals included lifting the basic income tax rate by roughly 2p and cutting National Insurance for basic-rate earners, alongside possible changes to the two-child benefit cap, though the status of these plans remains unclear.

The decision followed internal leadership tensions within Labour, marked by clashes between Wes Streeting and Starmer allies. Starmer extended an apology to Streeting to address the ongoing briefing war and leadership crisis. Conservative opposition highlighted the episode as evidence of political risk and chaos in Labour’s budget process.

Following the U-turn, UK gilt yields rose by more than 10 basis points in early trading, while the pound fell about 0.5% against the dollar, marking the market’s worst day since 2 July. Market analysts warned that the decision, reportedly driven by improved Office for Budget Responsibility (OBR) forecasts, signaled a shift from manifesto-based plans toward a budget relying on smaller tax increases and revised fiscal strategies.

The volatility has prompted calls from analysts like Kathleen Brooks of XTB to maintain credibility by broadening the tax base or cutting spending. Economists cautioned that using multiple smaller measures might bring risks such as uncertain revenue generation, economic harm, opposition from interest groups, and adverse reactions from bond investors.

Culture Secretary Lisa Nandy defended Reeves, stating she takes promises seriously and would not be reckless with public finances. Wes Streeting emphasized his opposition to breaking manifesto pledges, highlighting the importance of rebuilding political trust alongside pursuing economic and public service reforms.

Overall, the shift away from planned income tax increases underlines the complex interplay of political pressure, economic forecasts, and market reactions facing the UK government ahead of Budget 2025.