Long-Term Bitcoin Holders Shift to Net Accumulation After Major Sell-Offs

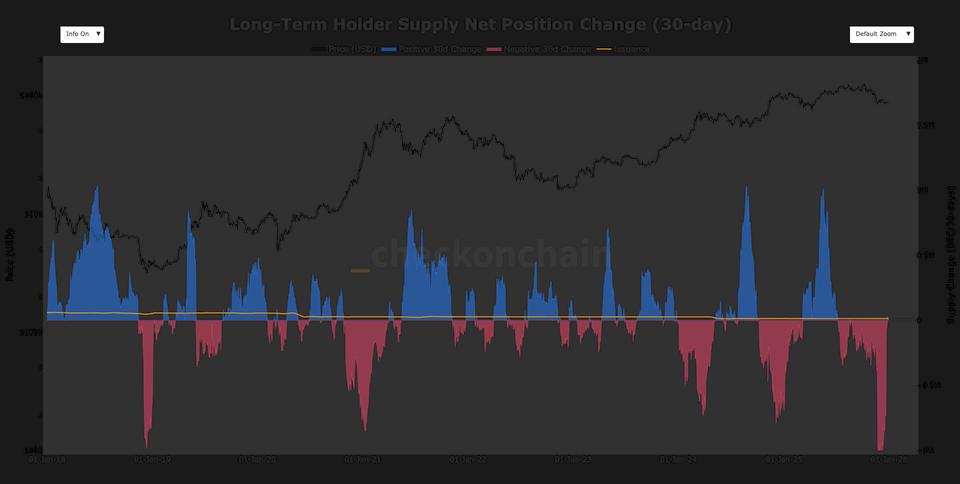

Long-term holders (LTHs) of Bitcoin, defined as those holding BTC for 155 days or more, have recently shifted from being net sellers to net accumulators, purchasing approximately 33,000 BTC on a 30-day net basis. This change suggests that buyers from the past six months are now maturing into holders, aided by the 155-day maturation period, and their accumulation is currently outpacing ongoing distribution.

During the current market correction, LTHs sold over 1 million BTC, constituting the largest LTH sell-pressure event since the 2019 bear market lows. This October correction, involving a 36% decline, marked the third major LTH distribution in the current cycle that began in 2023, following significant sell-offs in March 2024 and November 2024. Throughout this cycle, LTH selling has been one of the two largest sources of yearly sell pressure in the Bitcoin market, alongside miner capitulation.

The analysis is based on on-chain data compiled by checkonchain, highlighting the evolving behavior of long-term holders and their impact on Bitcoin's supply dynamics.