Standard Chartered Projects Bullish XRP Forecast, Targeting $8 by End-2026

Standard Chartered has maintained a bullish forecast for XRP, projecting that the cryptocurrency could reach $8 by the end of 2026, representing an approximate 330% upside. This optimistic outlook is supported by improved U.S. regulatory clarity and rising institutional interest.

Geoff Kendrick, the Global Head of Digital Assets Research at Standard Chartered, highlighted that clearer U.S. regulations enables institutional investors to gain exposure to XRP and reduces litigation risks related to Ripple and its token. The attraction of institutional investors is further evidenced by US-listed spot XRP ETFs, which have drawn roughly $1.25 billion in net inflows since their launch in November.

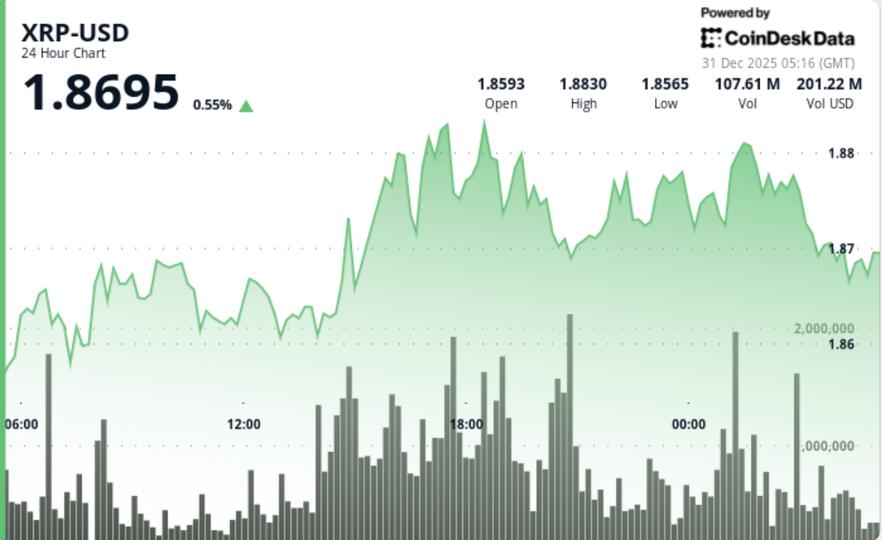

Currently, XRP is trading around $1.87, with trading volumes about 20.8% above the weekly average. The price has held near the $1.85 support zone, suggesting market positioning rather than signs of panic. Additionally, XRP exchange balances have declined to multi-year lows, indicating a reduction in liquid supply on trading venues.

Open interest in XRP derivatives has increased to approximately $3.43 billion, while spot netflows have been negative by about $10.7 million. This divergence implies rising leverage amid weak spot demand. Attention is also focused on January's scheduled escrow unlock of one billion XRP tokens, which is expected to increase market sensitivity regarding supply and liquidity, potentially triggering sharp price movements.

In terms of near-term price trends, if the $1.85 support holds and XRP reclaims the $1.88–$1.89 zone, the next targets could be the $1.92–$1.93 range, followed by $2.00 and the downtrend line near $2.08. Conversely, if the $1.85 support breaks, XRP may move toward $1.77, with deeper support levels at $1.60–$1.55.