STRF Emerges as Strategy's Standout Credit Instrument After Nine Months of Trading

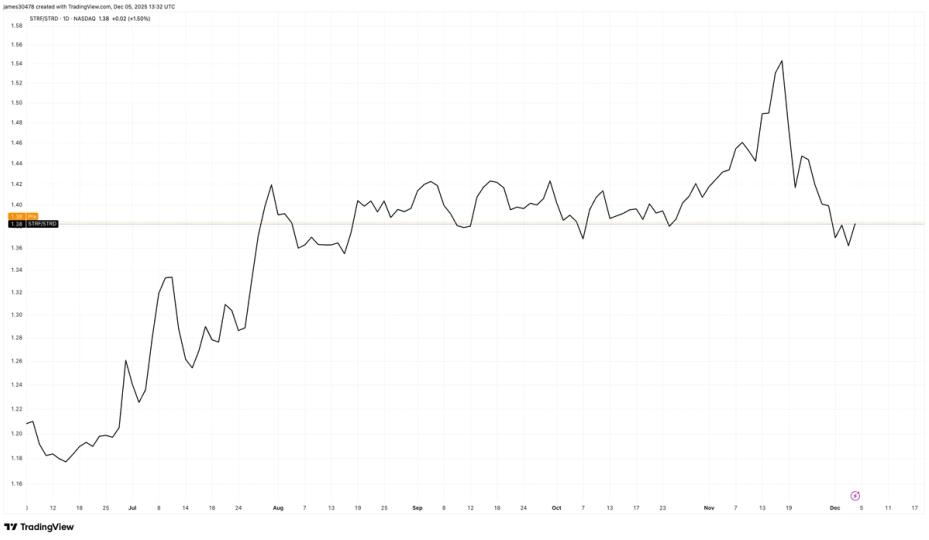

STRF is Strategy's senior perpetual preferred stock launched in March 2025 and currently trading around $110, marking a 36% increase from issuance and a 20% rise from the November 21 low of $92. The STRF-STRD credit spread peaked at 1.5 in late November and has since normalized to about 1.3, a significant improvement from the late October spread of 12.5%.

STRF offers an effective yield of about 9.03%, the lowest among Strategy's preferred offerings due to its premium price and long-duration credit profile. It pays a fixed 10% annual dividend and includes governance rights, along with penalty-based step-ups if payments are missed. Investor demand remains strong for STRF because of its senior protections, making it the standout credit instrument within Strategy's preferred suite.

Strategy's stock (MSTR) rebounded from a December low of $155 to about $185, signaling improved sentiment across the balance sheet and the bitcoin market. STRF's performance correlates with bitcoin prices, with the November 21 date coinciding with a local bitcoin bottom near $80,000.

The company maintains a $1.44 billion cash buffer reserve to cover preferred dividend payments. Additionally, STRC, another preferred instrument, has experienced four dividend rate increases, highlighting ongoing investor interest across Strategy's preferred instruments.