XRP Drops Below $1.93, Shifting Short-Term Market Structure

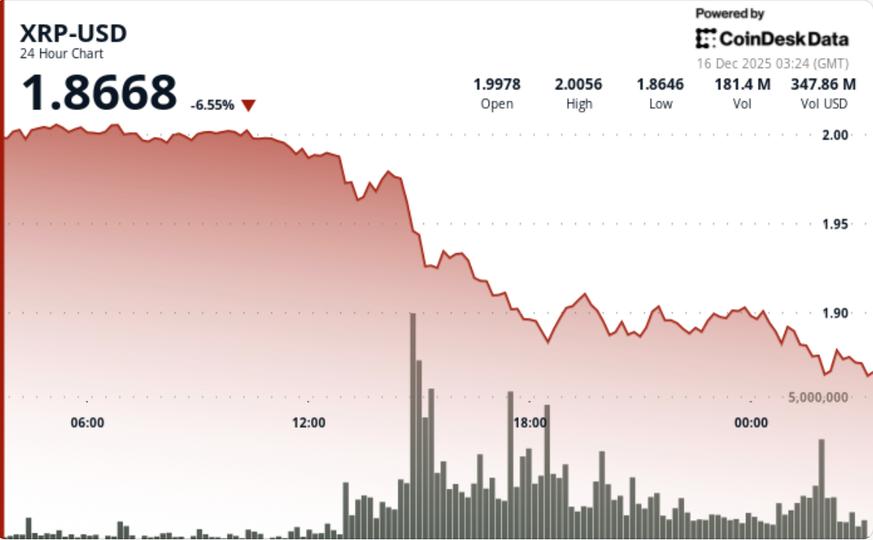

XRP fell 2.6% to $1.90 after failing to break resistance near $1.93. The breakdown below the $1.93 Fibonacci level is described as a technical failure, with volume rising 107% above daily averages, indicating active selling. This move marks a shift in the short-term market structure in favor of sellers, as the price remains capped below the $1.93–$1.95 zone. The price action has transitioned from range expansion to range rejection.

Immediate resistance for XRP stands at $1.93. To shift momentum back to neutral, XRP must reclaim that zone with strong volume. Support levels are near $1.88–$1.90. No fresh fundamental catalysts were cited for the recent selling pressure, which emerged as the price stalled near resistance, particularly during the European session.

After the breakdown, XRP stabilized near $1.90 and began consolidating above $1.88–$1.90, though no strong reversal signals have yet appeared. Volume behavior remains critical: continued selling on rallies could imply ongoing distribution, while fading volume near support might indicate a transition toward stabilization.