XRP ETF Inflows Surpass $1.25 Billion Amid Muted Price Movements

XRP ETF assets have grown to $1.25 billion, reflecting increased institutional demand as investors added $8.19 million in recent sessions. Despite the rising total ETF-held assets and steady spot ETF demand, XRP's price traded within a narrow range of $1.85 to $1.91, showing muted price action.

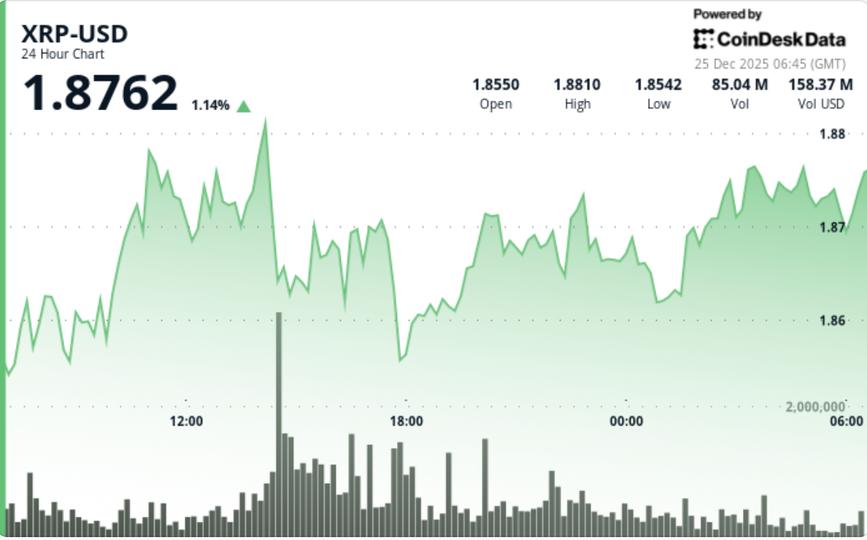

During the trading session, volume surged significantly, with 75.3 million units traded—about 76% above the average—indicating active participation rather than a slow drift in price. Trading saw a brief test of $1.862 on high activity but the price rotated back toward the $1.86 area as supply returned. The overhead resistance between $1.90 and $1.91 remained firm, with notable selling pressure near $1.90 and bids around $1.86, suggesting the market is poised for a potentially decisive breakout.

Price declined to $1.86 as traders sold into rallies, despite ongoing institutional interest. A close above the $1.90–$1.91 range could trigger short-covering and push prices toward $1.95 to $2.00. Conversely, a drop below $1.86 may lead to a decline toward $1.77–$1.80, a level where demand has historically provided support.

The broader cryptocurrency market exhibited a lack of follow-through momentum following Bitcoin's rebound, with major cryptocurrencies showing a risk-off, range-bound posture even as ETF inflows provided some stabilization.

Institutional appetite for XRP exposure appears to be moving increasingly toward ETFs and structured products, which help reduce custody and compliance friction.