XRP Price Rises Amid Shrinking Exchange Supply and Key Resistance Levels

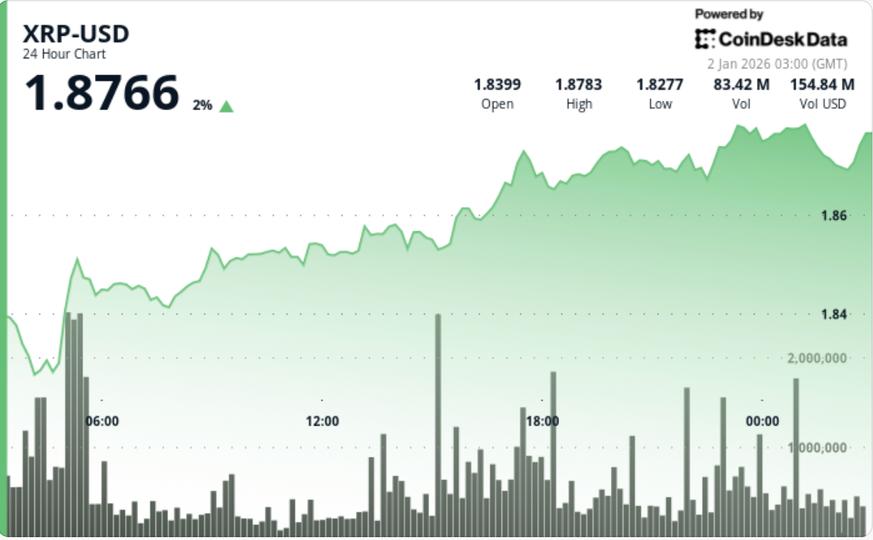

XRP price recently rose to $1.87, facing resistance near $1.88 within a broader band between $1.77 and $2.00. Notably, the supply held on exchanges dropped to about 1.6 billion XRP, a level not seen since 2018 and representing a decline of approximately 57% since October. This indicates that tokens are moving into longer-term storage or custody, which tightens the circulating supply.

The market context shows institutions increasingly using regulated rails, while spot markets remain choppy, creating a long-term bid but fragile near-term momentum. Trading volume on the move was around 32 million XRP, roughly 50% above average, suggesting that the price action reflects active buying rather than price drift.

Technically, momentum indicators show divergence without a clear breakout above resistance levels. Key price levels include a support zone at $1.82 to $1.83 and a demand floor at $1.77. Resistance levels stand at $1.88 as a major ceiling and $2.00 as a breakout trigger. A sustained move above $1.88 to $2.00 is necessary to shift market dynamics upward. Conversely, failure to hold the base support could lead to a decline back toward $1.77.

Overall, the shrinking exchange supply supports a constructive longer-term outlook for XRP, but positive momentum depends on breaking decisively above the $1.88 to $2.00 resistance band.