XRP Sentiment Hits Extreme Fear as TD Sequential Flashes Early Reversal Signal

XRP's social sentiment has collapsed to extreme fear levels, similar to those seen in October, with bear commentary reaching a five-week high according to Santiment. This sentiment historically precedes short-term rebounds.

The cryptocurrency's weekly performance shows a decline of 7.4%, continuing a multi-session downtrend despite ongoing institutional demand through U.S. spot XRP ETFs, which have amassed $906 million in net inflows without any outflow days since their launch.

Price action is forming a descending channel, with a pivotal support level at $2.030 needed to avoid deeper declines. Immediate resistance is observed around $2.04 to $2.05. On-chain data reveals that 6–12 month holders have reduced their exposure from 26.18% to 21.65%, although long-term ETF-driven demand continues to accumulate.

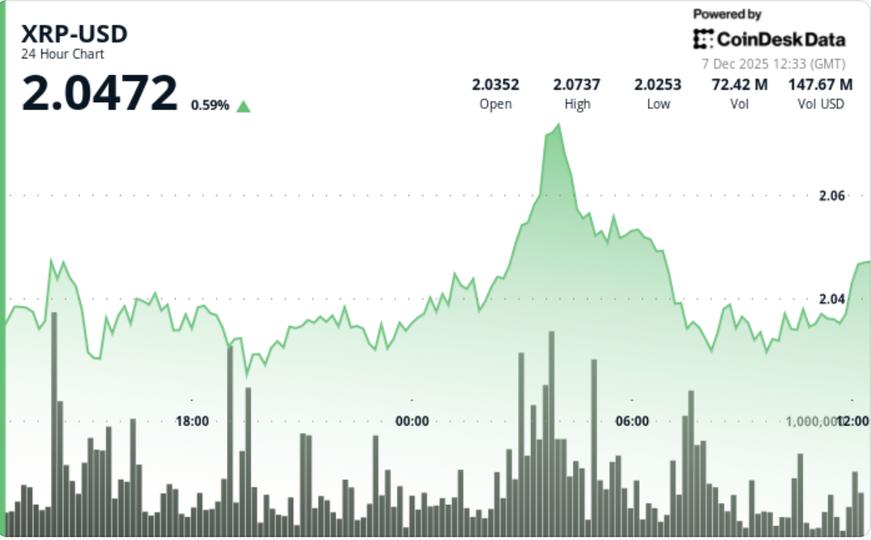

Technical indicators point to a weekly TD Sequential potential reversal signal. Intraday momentum weakened after a brief breakout above $2.05, fueled by a volume spike to $2.07, which failed to sustain and led to a pullback.

Volume dynamics suggest distribution rather than accumulation, highlighted by a 44.99 million volume spike at the $2.07 breakout (68% above the simple moving average), followed by a fade with only 1.08 million volume near the low at $2.029.

Currently, XRP trades around $2.030 after fluctuating between $2.02 and $2.07. A move above $2.035 would restore intraday momentum, while a clean break above $2.05 is necessary to invalidate the descending channel. Should the $2.030 support give way, a test of $2.020 to $2.025 is expected, with potential further support at $2.00.