XRP Underperforms Market as Sudden Bitcoin Surge Ends Up in $387M Liquidations

A recent surge in Bitcoin prices, rising above $94,000, triggered a broad market rebound resulting in $387.5 million in liquidations across major derivatives within 24 hours, impacting 107,333 traders including a notable $23.98 million BTC long liquidation on HTX.

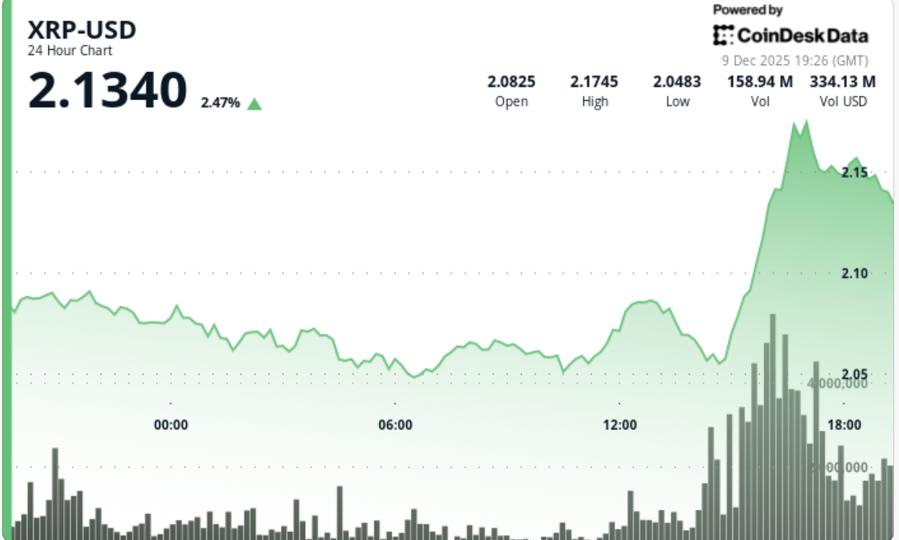

Despite this strong Bitcoin rally, XRP posted gains but underperformed the broader digital-asset rally. XRP's trading volume was 5.88% below its 7-day average, showing below-average volume and a lack of meaningful acceleration in institutional flows despite price gains. In relative terms, XRP underperformed the CD5 index by approximately 1.55%, suggesting capital rotation away from XRP during the risk-on move.

Technically, XRP exhibited higher highs and higher lows but showed inconsistent momentum compared to other major assets. Key technical levels hold a support at $2.05 and resistance at $2.17. A breakout attempt towards $2.17 was accompanied by a surge of 128.7 million tokens—147% above the 24-hour average—but subsequent participation dropped, signaling near-term hesitancy. The next meaningful support if $2.05 fails lies between $1.98 and $2.00, where ETF-driven demand has recently provided a stabilizing factor.

Market dynamics indicate a rotation into higher-beta assets during Bitcoin-led surges, which could lead to a delayed catch-up for XRP or potentially deeper consolidation if macro momentum fades. The next 24 to 48 hours are critical for confirmation, with continued Bitcoin strength above $94,000 possibly supporting a delayed upside for XRP rather than immediate acceleration.